Little Known Questions About Hard Money Atlanta.

Wiki Article

The Basic Principles Of Hard Money Atlanta

Table of ContentsThe smart Trick of Hard Money Atlanta That Nobody is Discussing3 Simple Techniques For Hard Money AtlantaHard Money Atlanta Things To Know Before You BuyThe Basic Principles Of Hard Money Atlanta Hard Money Atlanta - The Facts

These tasks are typically completed rapidly, thus the need for quick accessibility to funds. Revenue from the project can be used as a down settlement on the next, as a result, tough cash loans permit capitalists to range and flip even more buildings per time - hard money atlanta. Offered that the repairing to resale timespan is brief (normally less than a year), residence fins do not need the lasting finances that traditional home loan loan providers use.Typical lending institutions might be taken into consideration the antithesis of hard cash lending institutions. What is a hard cash loan provider?

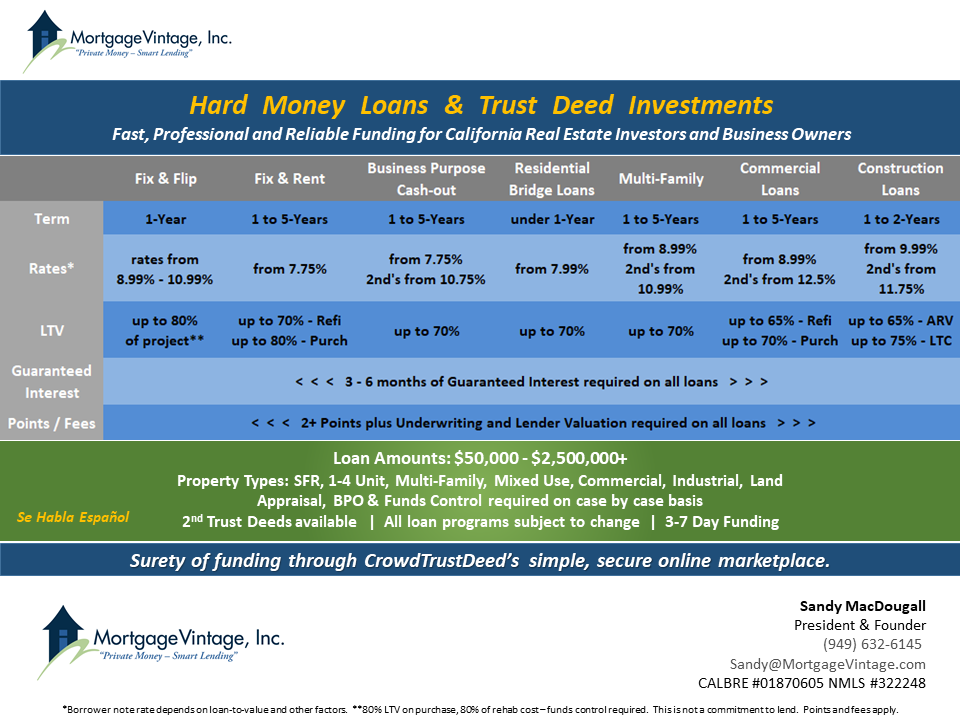

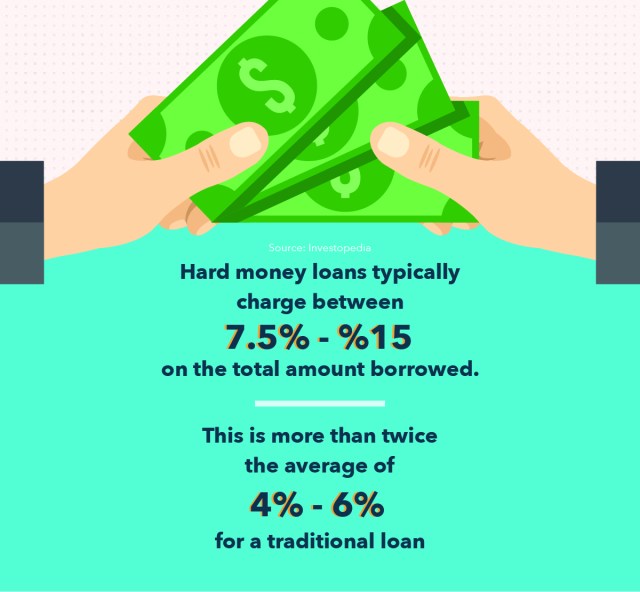

Typically, these elements are not the most essential factor to consider for funding certification. Interest rates might additionally vary based on the lender and also the offer in inquiry.

Hard cash loan providers would likewise charge a cost for offering the funding, and also these charges are also called "points." They generally end up being anywhere from 1- 5% of the complete loan sum, nonetheless, factors would typically equate to one percentage point of the lending. The significant difference in between a hard money lending institution and other lenders hinges on the authorization procedure.

An Unbiased View of Hard Money Atlanta

A hard money loan provider, on the various other hand, concentrates on the asset to be bought as the leading consideration. Credit history, revenue, and also other individual needs come additional. They also differ in regards to convenience of access to funding as well as rates of interest; difficult money loan providers provide moneying rapidly and bill higher passion rates as well.You can locate one in among the complying with means: A basic internet search Request suggestions from local property agents Request recommendations from investor/ capitalist groups Since the loans are non-conforming, you should take your time evaluating the requirements and also terms offered prior to making a computed and also educated choice.

It is vital to run the numbers before selecting a difficult cash lending to make sure that you do not face any type of loss. Make an application for your hard money funding today as well as get a lending dedication in 1 day.

A hard cash funding is a collateral-backed funding, safeguarded by the genuine estate being acquired. The dimension of the car loan is determined by the estimated value of the property after suggested fixings are made.

9 Easy Facts About Hard Money Atlanta Described

Most tough money fundings have a term of six to twelve months, although in some instances, longer terms can be prepared. The debtor makes a regular monthly repayment to the lending institution, generally an interest-only repayment. Right here's how a regular tough cash funding works: The borrower wants to buy a fixer-upper for $100,000.

Bear in mind that some loan providers will require more cash in the offer, as well as ask for a minimum down repayment of 10-20%. It can be advantageous for the investor to seek the lending institutions that call for very little down repayment choices to reduce their cash money to close. There will likewise be the common title fees connected with shutting a purchase.

Make certain to contact the difficult cash loan provider to see if there are prepayment fines billed or a minimal return they need. Presuming you remain in the finance for 3 months, as well as the residential property costs the forecasted $180,000, the capitalist earns a profit of $25,000. If the residential or commercial property offers for even more than $180,000, the customer makes also more cash.

Due to the shorter term and high rate of interest prices, there typically needs to be improvement and upside equity to catch, whether its a flip or rental residential or commercial property. Initially, a difficult money funding is perfect for a buyer who desires try this web-site to fix and also turn an undervalued home within a fairly brief duration of time.

Examine This Report about Hard Money Atlanta

It browse around here is very important to know exactly how tough cash lendings work and also exactly how they vary from traditional car loans. Financial institutions and also various other standard economic organizations stem most lasting loans and also home loans. These conventional lending learn this here now institutions do rarely deal in hard cash lendings. Rather, hard money loans are issued by personal capitalists, funds or brokers who ultimately resource the bargains from the private capitalists or funds.

The smart Trick of Hard Money Atlanta That Nobody is Discussing

When applying for a difficult money funding, customers require to show that they have adequate resources to successfully survive a deal. Having previous genuine estate experience is also a plus. When thinking about just how much cash to lend, numerous hard cash lending institutions think about the After Serviced Value (ARV) of the residential or commercial property that is, the estimated value of the home after all enhancements have been made.Report this wiki page